Coal industry mired in decline despite Trump pledges

President Trump has moved aggressively in his first year in office to roll back regulations he says have harmed America’s coal miners. But the industry itself remains mired in long-term decline, a downturn that one of Trump’s own government agencies predicts will only worsen over time.

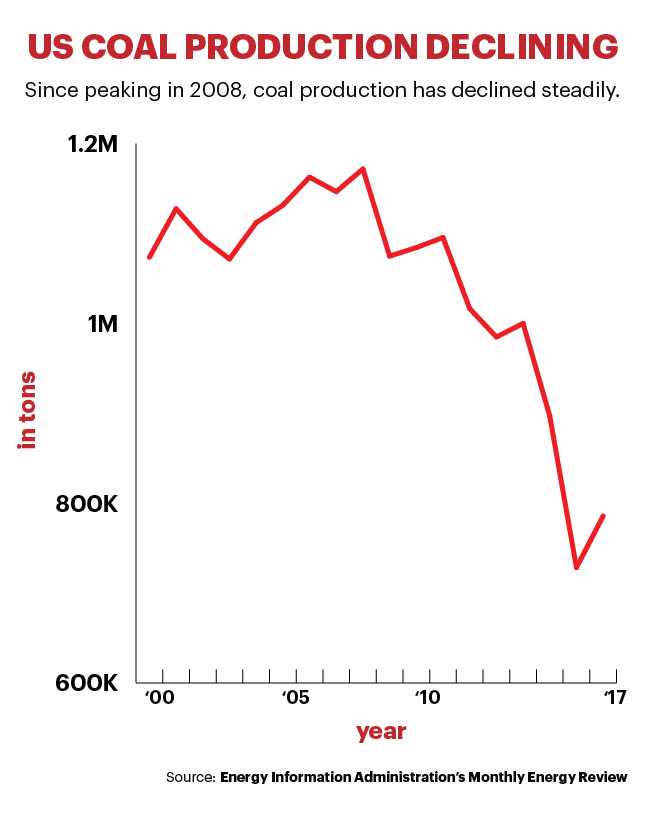

New projections from the Energy Information Agency (EIA) estimate that Americans will be less dependent on coal, that coal production will fall, and that coal capacity in the nation’s power plants is likely to decline in coming years, according to an annual report released last month.

The war on coal, in short, is over. And coal lost.

Experts say regulations, like those put in place during the Obama administration, may have hastened the demise of a once-dominant industry. But the decline started with market forces far more powerful than any presidential administration, including changing demands and the low cost of natural gas.

{mosads}“Coal in the U.S. is in secular decline. It’s more than regulation, and it’s more than environmental concerns,” said Anna Zubets-Anderson, a vice president and senior analyst at Moody’s Investors Services.

“The deregulation push is not something we think makes a material impact,” said Molly Shutt, a commodities analyst at BMI Research.

That’s not to say the administration hasn’t tried to aid the coal industry. In the last year, Trump put the brakes on the Obama administration’s Clean Power Plan, which created new environmental requirements for coal-fired power plants. In his first weeks in office, he signed legislation overturning the Obama-era Stream Protection Rule.

“The regulatory issues are what the president can do right now,” said Travis Deti, executive director of the Wyoming Mining Association. “The channels of communications are open again between the industry and the agencies.”

But, Deti added, “The years of mining 400 million tons of coal per year, those days are gone. We’re in a new normal.”

Government data sheds light on just how quickly coal has declined in recent years.

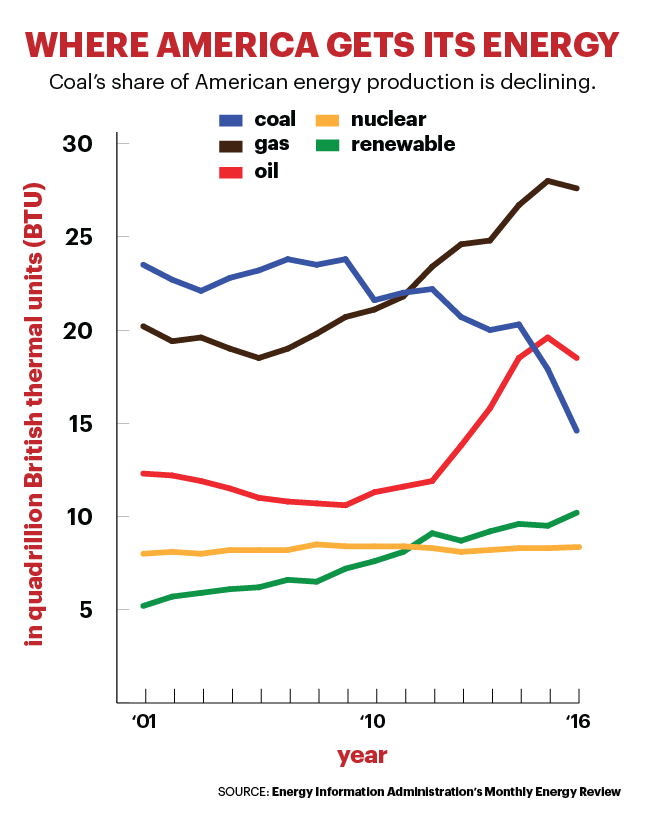

A decade ago, coal was the most common source of energy Americans used, accounting for about a third of total energy production, according to the EIA. In 2016, the last year for which final figures are available, that share dropped to less than 20 percent. Now, gas and oil make up larger shares of the American energy portfolio.

Coal’s share of the energy market is now just 40 percent larger than the share made up by renewable energy. In the last 15 years, coal has declined by a third, while renewables have doubled.

“Our share is decreasing. And if you look long term, that’s probably a trend that’s going to remain in place,” Deti said. “The market says something, and consumers say something, and utilities say something. And it’s different than it was 10 years ago.”

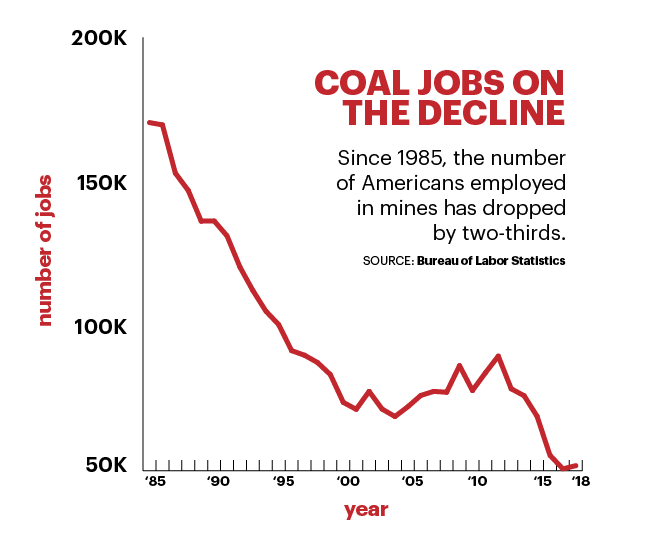

The industry itself has shed jobs at a furious clip. Today, just about 52,000 Americans are employed in coal mines, according to the Bureau of Labor Statistics. In 1985, more than 170,000 Americans worked in the mines.

{mosads}A decade ago, energy analysts might have said oil and natural gas were the energy sources most susceptible to decline. But new technologies like hydraulic fracturing, known as fracking, have bolstered those industries, making oil and gas far cheaper than coal. A booming renewable energy sector is adding both jobs and capacity, especially in Western states.

At the same time, energy companies that make decisions about investments in new power plants on a decades-long basis are choosing gas over coal. In the next decade, analysts at BMI Research anticipate energy firms will retire coal-fired power plants that account for 20 gigawatts of power, about 10 percent of the total amount of U.S. coal capacity. Those same companies will bring online natural gas plants that can generate up to three times that much power.

The EIA projects American consumption of all energy sources except coal will rise significantly in the next several decades. At the same time, coal production is expected to decline by an estimated 85 million short tons, or more than 10 percent, within the next five years.

Production declines are likely to hit two of America’s three main coal regions particularly hard. In central Appalachia, where hot-burning and relatively clean coal is some of the best in the world, production costs are rising as miners are forced to dig deeper. And in the Powder River Basin, a lack of access to western ports that could ship coal to Asia means higher transportation costs.

That threatens states like West Virginia and Wyoming, where for generations blue-collar workers used the coal industry to build a middle class life for themselves and their families.

“We’re talking about jobs where we have people with only a high school diploma making $70,000 or $75,000 a year,” said John Deskins, director of the Bureau of Business and Economic Research and an associate professor of economics at West Virginia University. “A bounce back to what we considered normal a decade ago is very unlikely.”

In Wyoming, where about 20 percent of the state’s revenue comes from taxes associated with mining, the legislature now faces a budget deficit.

“We’ve been living high and heady for a long time, and with the decline of the industry in the last couple of years and the crash, it’s significant,” Deti said. “When that revenue declines, obviously the state is crunched.”

If there is any bright spot for the coal markets in recent years, it is in exports, which have increased under the Trump administration. Those exports disproportionately come from Midwestern coal mines, which have higher heat values and can be shipped to Asia via the Mississippi River.

“The biggest source of growth over the last year has been exports,” Deskins said.

But even then, the EIA says exporting coal to China and other Asian nations won’t make up for the global slump. Exports, the agency said, are not expected to increase significantly over the coming decades.

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..