Financial markets brace for default as Biden, Republicans dig in on debt limit

The partisan standoff over the debt limit, which hardened over the weekend when 43 Senate Republicans said they would not support a clean debt limit increase, sets the stage for severe turbulence in the financial markets, experts warn.

The yield on Treasury bonds maturing next month spiked last week, signaling that investors are already preparing for the possibility President Biden and Republican leaders in Congress won’t reach a deal before the Treasury Department runs out of money next month.

Biden will meet with the top four congressional leaders at the White House on Tuesday to discuss how to avoid a default, but lawmakers expect little progress from the meeting. It’s the first face-to-face meeting between Biden and Speaker Kevin McCarthy since Feb. 1.

There’s growing pessimism in Washington and the financial markets that political leaders will negotiate a long-term deal by early June, the deadline set by Treasury Secretary Janet Yellen.

If an agreement doesn’t come together in the next month, congressional leaders will have to agree to a short-term extension of the debt limit to give themselves more time to negotiate.

More debt ceiling coverage from The Hill:

- Pressure grows on Biden to bend in debt ceiling talks

- 10 questions answered on the debt limit

- Debt limit battle: How we got here

- What would a debt ceiling failure mean for Americans?

Without a short-term agreement, the U.S. would go past the so-called “X-date” and face major turmoil in the markets.

“I genuinely believe there’s a better than 50 percent chance that there will be default; it will occur over a weekend and when the chaos it creates becomes obvious to all the players, they’ll have to reach some sort of accommodation,” said former Sen. Judd Gregg (R-N.H.), who served as Senate Budget Committee chairman and an adviser to Senate Republican Leader Mitch McConnell’s (Ky.) leadership team.

“The potential is pretty dire,” he warned. “Right now, you don’t have the leadership to solve the problem; that’s the bottom line.”

Gregg said McCarthy faces a challenge to his speakership if he brings a debt limit bill to the House floor without major fiscal reforms, but the cuts he’s proposing don’t have a chance of passing the Senate.

McConnell’s support for a letter signed by 43 Senate Republicans declaring they will not support “any bill that raises the debt ceiling without substantive spending and budget reforms” has failed to move Democrats away from insisting on a clean debt ceiling increase.

“I don’t know what Democrats have to negotiate,” said a senior Senate Democratic aide, who pointed out Republicans agreed to raise the debt limit three times under former President Trump without drama. “We’re not the ones being inconsistent.”

“At the end of the day, a lot of their behavior is playacting,” the aide said, predicting a spike in stock and bond market volatility will pressure Republicans into backing off their demands. “They have investments, too.”

The aide, pointing to the downgrade of the nation’s credit rating in the 2011 debt limit standoff, said that this year’s battle in Washington over the debt ceiling would also shake the financial markets.

“We have in the past. I don’t know why this would be different,” the aide said.

Financial markets are already starting to show signs of stress related to the impasse over the debt ceiling.

One-month Treasury bills maturing around a projected date in early June, when the government could run out of money, saw their yields spike to 5.76 percent last week.

Yields have climbed far above recent averages closer to 4.5 percent and significantly higher than the recent low of 3.3 percent in April.

“The Treasury bills curve appears to imply risk of disruption in June, July, and October,” Goldman Sachs chief economist Jan Hatzius wrote in a note last week to investors.

Treasury bills maturing in early June were trading at more than a 50-basis point discount compared to May and July at the end of last week.

“Investors are paying a healthy premium to own bills that mature in May while demanding hefty compensation to hold T-bills that are maturing in the first half of June,” analysts for Wells Fargo wrote in a note to investors last week.

Wall Street insurance policies, which are known as credit default swaps, against one-year Treasuries hit a record-high spread of 1.77 percent late last week in a spike that was notable for its timing and its size.

“There is likely genuine fear that a divided government and increased political polarization could make finding a solution less likely. Meanwhile, the dual threats of rising deficits (with larger federal payments, some indexed to inflation) and higher Treasury debt service costs also increase the chance of an accident, contributing to the higher perceived riskiness of owning U.S. debt,” Deutsche Bank analyst Steven Zeng wrote in a May 5 note.

Uncertainty in the Treasury market, which is already dealing with one of the fastest quantitative tightening cycles in decades, could spell more trouble for the U.S. banking sector.

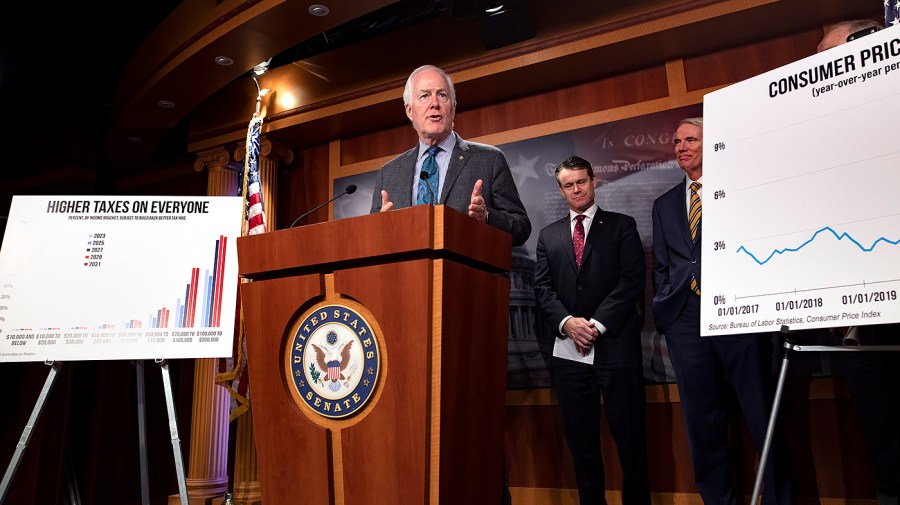

Sen. John Cornyn (R-Texas), an adviser to the Senate Republican leadership team, said local and regional banks in his state worried about losing deposits.

“This is a very dangerous situation. There’s been a big shift in deposits to places people perceive as safer,” he said. “All of them are nervous, our community bankers, our regional bankers. We need to try to calm this down.”

Cornyn said the possibility of a national default isn’t helping to calm the jittery banking sector.

“I think it’s creating unnecessary anxiety,” he said.

One senior Senate Republican aide warned a drop in demand for Treasury securities could trigger a broader market selloff.

Treasury security auctions likely will become increasingly sensitive to the Treasury Department’s looming X-date, analysts say.

“Yields are elevated beginning with the June 6 maturity, which the Treasury in January suggested was the soonest the Treasury could exhaust resources under the debt limit,” analysts for Goldman Sachs wrote. “The yield is highest around mid- to late-July maturities, when we think the Treasury will have exhausted resources under the debt limit if it has not in June.”

Auctions scheduled for this Thursday for four-week and eight-week bills due to mature within this time frame could see some additional stress, as could auctions on May 25, June 8 and June 15.

The Bipartisan Policy Center argued in an analysis published Tuesday that “managing Treasury security auctions and meeting all obligations will become increasingly challenging as reserves dwindle.”

“Concerns are also mounting that the country could find itself in a similar position to 2011, when Standard & Poor’s downgraded the U.S. from its AAA rating,” the think tank said.

Yellen warned in an interview with ABC’s “This Week” that “it’s widely agreed that financial and economic chaos will ensue” if Congress fails to act by the deadline.

A report published by the Penn Wharton Budget Model on Monday said the deadline to raise the nation’s debt ceiling will hit sooner than thought because tax receipts in April fell below projections.

Alexander Arnon, the director of business tax and economic analysis for the Penn Wharton Budget Model, said “we found, as noted by the Treasury secretary and by the Congressional Budget Office, that tax receipts in April came in quite a bit lower.”

“There was a drop off [in tax receipts] relative to what was expected and we are much closer [to default] than people had hoped earlier this year,” he said.

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..