Surprise jobs data gives boost to Biden

A surprisingly strong December jobs gain is good news for President Biden as the prospect of the long-sought-after “soft landing” comes into greater focus at the start of an election year.

Payrolls came in hot in December with 216,000 new jobs added to the economy and the unemployment rate remaining low at 3.7 percent, according to the Labor Department.

The December jobs report was another upside surprise for a labor market that defied economists’ expectations throughout 2023. But the promising state of the economy is hardly a lock in voters’ minds for the president.

Despite ample salesmanship, Biden’s economic approval ratings are low. Just 32 percent of Americans gave Biden a thumbs up on the economy in a November Gallup poll.

His overall approval ratings are also weak, with 39 percent of Americans giving him a passing grade in December polling. That’s still a slight improvement from his November rating of 37 percent.

And Biden currently trails former President Trump, his likely Republican opponent, by 2 percent in The Hill/Decision Desk HQ poll tracker.

The state of the economy is likely to be top-of-mind for voters, so 2024 promises to be a year of intense economic rhetoric and argumentation. Here’s how the first jobs report of the year sets the stage.

The airport is ‘on the horizon’ for the soft landing

FILE – United States Secretary of the Treasury Janet Yellen speaks at the Atlantic Council Global Citizen Awards, Sept. 20, 2023, in New York. Yellen wants Latin America to trade more with the United States as part of an initiative that so far has failed to disrupt China’s dominance in global manufacturing. (AP Photo/Julia Nikhinson, File)

The December jobs report is boosting confidence among policymakers that the U.S. economy is in a “soft landing,” or the rebalancing of the economy toward slow and steady growth from high inflation without a recession.

After the federal government pumped trillions of dollars in stimulus into the economy and inflation took off in 2021, the Fed started raising interest rates in 2022 to slow things down, leading many economists to believe a recession was inevitable.

But despite many wrong predictions, a recession failed to materialize in 2023. The strong jobs numbers from December — along with wage growth of 4.1 percent over the past year — are yet more evidence for the soft landing scenario.

“What we’re seeing now I think we can describe as a soft landing, and my hope is that it will continue,” Treasury Secretary Janet Yellen said Friday in an interview on CNN.

“The American people did it,” she added. “The American people go to work every day, participate in the labor market, form new businesses. But President Biden has tried to create incentives that give Americans the tools they need to help this economy grow.”

More Top Stories from The Hill

- Wayne LaPierre resigns as NRA head

- House prepares contempt of Congress resolution for Hunter Biden

- New York AG asks judge to force Trump to pay $370M in fraud case

- Trump attorney says Kavanaugh will ‘step up’ in ballot cases

Yellen’s former Fed colleagues have also noted as much.

“The airport is on the horizon,” Tom Barkin, president of the Federal Reserve Bank of Richmond, said in a speech Wednesday. “Everyone is talking about the potential for a soft landing, where inflation completes its journey back to normal levels while the economy stays healthy. And you can see the case for that.”

Optimism among investors is also percolating.

“Two consecutive positive jobs reports and solid consumer spending amid easing inflation are welcome news both for consumers and investors,” Stephen J. Rich, head of investment firm Mutual of America Capital Management, wrote in a statement sent to The Hill. “A soft landing for the economy appears much more likely.”

Parties battle for control of narrative

Rep. Richard Neal (D-Mass.) addresses reporters during a press conference on Tuesday, May 23, 2023 to introduce a social security bill. (Greg Nash)

Democrats were eager to cheer the Friday jobs report as evidence that their policies are working as the party and Biden attempt to flip voter sentiment on the economy.

“Another strong report to round out a year of sustainable job growth, and growing the economy from the bottom-up and middle-out is the new pro-worker, pro-growth strategy,” Rep. Richard Neal (D-Mass.), ranking member of the House Ways and Means Committee, said Friday.

“By every measure, it’s working.”

Republicans, however, are keeping the focus on cost increases endured by Americans over the past two years thanks to four-decade-high inflation and the Fed’s rapid rate hikes.

“The average monthly mortgage payment has increased by $1,089 and is 96 percent higher than when President Biden took office in January 2021,” Ways and Means Republicans said in a statement.

“Consumer credit debt has reached an all-time high of just over $1 trillion and the number of Americans struggling to pay credit card bills has increased sharply.”

“As the calendar turns to 2024, working families see an administration pushing the same failed policies of ‘Bidenomics’ that have caused such financial and economic struggle, frustration, and anxiety,” Ways and Means Chair Jason Smith (R-Mo.) said.

Inflation is falling and gas prices are easing

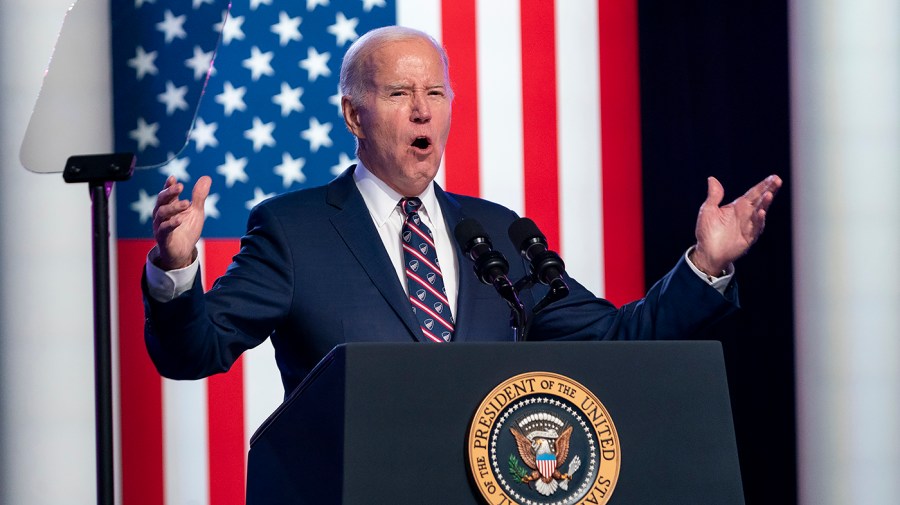

President Biden gives a campaign speech on the eve of Jan. 6 attack of the Capitol at Montgomery County Community College in Blue Bell, Pa., on Friday, January 5, 2024. (Greg Nash)

While Americans are still dealing with elevated inflation, Democrats are hopeful that slowing price growth will bolster their pitch to voters.

Inflation has dropped from a 9-percent annual increase in June 2022 to a 3.1-percent increase this past November, according to the Labor Department’s consumer price index (CPI).

The dip in inflation comes as wage increases have broadly kept pace, with a 4.1-percent annual increase in average hourly earnings reported Friday by the Labor Department.

For the lowest-paid workers in the economy, their wage increases have outpaced inflation for a net gain throughout the pandemic.

And gas prices, which are some of the costs that consumers feel most acutely, are also on the retreat.

The national average price for a gallon of gas was $3.09 on Friday — a far cry from the $5 peak at the height of inflation.

“Right now, the average driver in America is spending over $100 less than if gas prices had stayed at their peak,” Biden touted in a Friday post on X, formerly known as Twitter.

Rate cuts may be delayed as job market holds strong

Federal Reserve Board Chair Jerome Powell speaks during a news conference about the Federal Reserve’s monetary policy at the Federal Reserve, Wednesday, Dec. 13, 2023, in Washington. (AP Photo/Alex Brandon)

Investors had started to price in rate cuts for some time this year in anticipation of inflation returning to the Fed’s 2-percent annual expectation.

That could lead to an additional boost for the stock market, which is already near record highs, with the S&P 500 index of major U.S. stocks up nearly 600 points since the end of October.

But the strength of the Friday jobs report will likely mean the Fed will push back rate cuts.

The chances of the Fed holding rates steady at its next meeting at the current range of 5.25 to 5.5 percent were clocked by the CME Fedwatch prediction algorithm on Friday at 95 percent.

Strengthening consumer sentiment may also be a tailwind for Biden heading into 2024, with the Michigan Survey of Consumer Sentiment soaring 14 percent in December.

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..