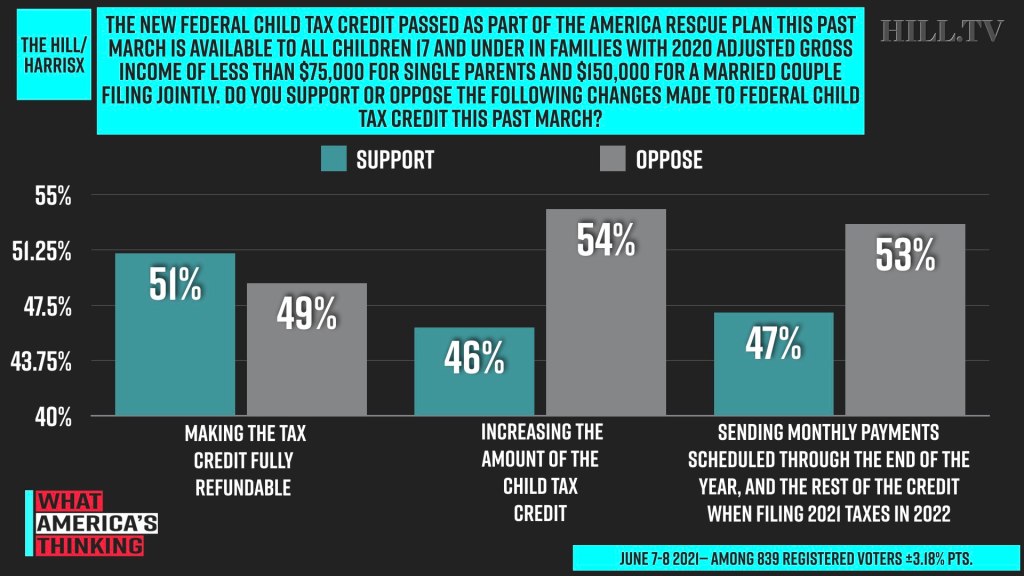

A slim majority of voters support making the new federal child tax credit fully refundable, a new Hill-HarrisX poll finds.

Fifty-one percent of registered voters in the June 7-9 survey said they support making refundable the new federal child tax credit that was recently passed as part of the latest COVID-19 economic relief package.

Fifty-four percent of respondents said they oppose increasing the amount of the tax credit and 53 percent said they oppose sending monthly payments scheduled through the end of the year and the rest of the credit when filing 2021 taxes in 2022.

A plurality of voters, 44 percent, said some families eligible to receive the tax credit don’t need it, while 30 percent said some families who are not eligible do need it. Twenty-six percent said the credit is going to exactly the parents who need it.

More voters said single parents who make less than $75,000 should qualify for the credit, while 48 percent said married couples who make less than $100,000 should qualify.

The Biden administration announced it will start to make monthly payments of the expanded child tax credit on July 15.

The most recent Hill-HarrisX poll was conducted online among 839 registered voters. It has a margin of error of 3.18 percentage points.

—Gabriela Schulte

hilltv copyright