How the recession’s long hangover lingers

In the depths of the Great Recession, Robert Bowen got a phone call from a customer in distress.

Bowen is the president of Brighton Bank, a 40-year-old community bank with branches across Utah’s Wasatch Front. Brighton manages only about $200 million in assets, a fraction of what the “too big to fail” institutions in New York and Charlotte, N.C., handle. The vast majority of the loans Brighton makes are to small businesses in Ogden, Salt Lake City and Provo.

{mosads}The customer who called Bowen had purchased their building, thanks to a Brighton loan. But the recession meant they had fallen far short of the rental revenue they had anticipated. To make payments, the company had sold other properties. One of the company’s executives liquidated her 401(k) and put her personal residence up as collateral.

Brighton had two options: foreclose on the building and force the company out of business, or work with a good customer that had fallen on hard times. The bank opted to restructure the terms of the company’s loan, allowing the firm to pay off interest only while the economy rebounded.

“When we see a borrower who’s willing to do that, we really bend over backwards,” Bowen said in an interview. Today, the company has a building full of tenants, and the loan payments are coming in on time.

“They’ve rebounded. They’ve filled up the building. They’ve been able to debt-service,” Bowen said. “They’ve returned some of the value of their building, and things are looking much brighter for them. They may get some of their equity back.”

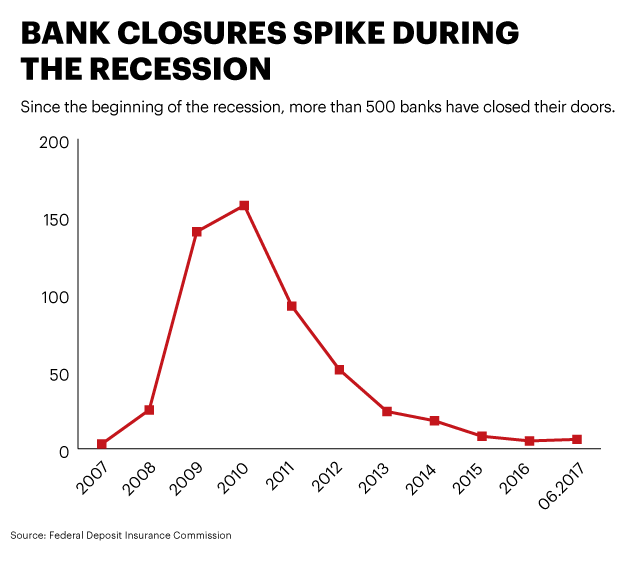

But in the wake of the most devastating recession in generations, there are fewer banks like Brighton. Since the beginning of the recession, more than 500 community banks have closed.

That means fewer jobs, not just in the banking sector but also among new businesses that rely on those banks for crucial start-up loans. It is a hangover of the recession, one for which there is no immediate or obvious solution. And that hangover spurred the revolt against elites in coastal cities that sent Donald Trump to the White House instead of Hillary Clinton.

This is the 10th part in The Hill’s Changing America series, in which we explore the trends shaping society and politics today. The dominant economic trends contrast the rising power and success of large metropolitan areas with the slow, painful decline of rural regions — both of which are exacerbated by a growing disparity between where new jobs are created and how those jobs are formed.

The recession cost America more than 2 million manufacturing jobs, and tens of thousands of small businesses shut their doors for good. It hit cities and rural areas alike.

But the United States has clawed its way out of previous recessions in part because Americans, and immigrants to America, are an entrepreneurial set, and new businesses are the key to job growth: More new jobs are created by new businesses than by companies that have been around for many years, economists say.

“New firms are closely associated with economic dynamism,” said Arnobio Morelix, a senior research analyst at the Kauffman Foundation in Kansas City, Mo. “If they’re a new company, they’ve really got to hire more people and increase their footprint if they want to grow.”

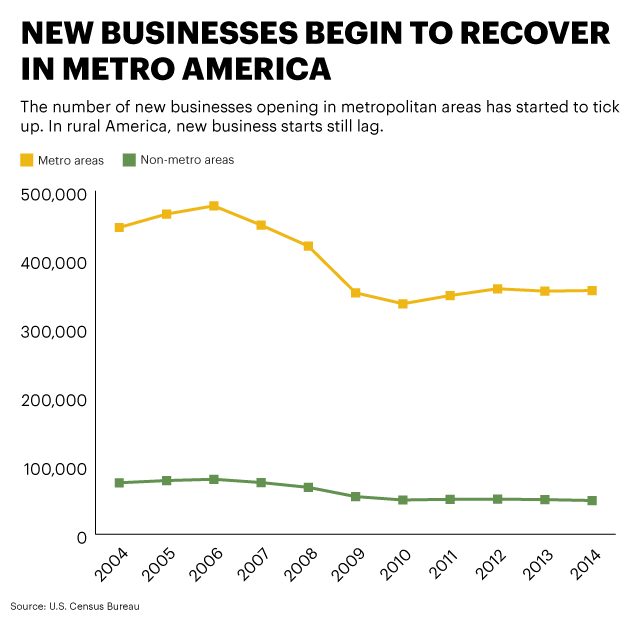

In the aftermath of this recession, the pace of new business growth has slowed: About 404,000 new businesses were founded in 2014, according to the Census Bureau, about the same number as in 2009, at the depth of the recession. In 2006, by contrast, more than 558,000 new businesses were created.

New businesses today have been created disproportionally in major cities. Just five cities — Miami, Los Angeles, New York, Dallas and Houston — account for the same net increase in businesses as the rest of the country combined, according to an analysis by the Economic Innovation Group.

“The growth that this country saw after the recession during the recovery was pretty much dominated by a handful of super-performing metropolitan areas,” said Steve Glickman, EIG’s executive director and a former senior economic adviser in the Obama administration.

“Before the recession, pretty much 90 percent of counties saw businesses on net gain year after year,” Glickman said. “After the recession, there was this set of counties that saw more businesses close than open.”

A major factor in new business growth is access to the capital necessary to get off the ground. The good news for those who want to start a new business is that low interest rates set by the Federal Reserve means borrowing costs have never been cheaper.

The bad news is that large banks are lending to small businesses at lower rates than before the recession, according to the Federal Deposit Insurance Corp.

And there are fewer community banks like Brighton to pick up the slack.

Since the turn of the century, 551 banks have failed, according to the FDIC. Just 25 failed between 2000 and 2007 — the same number as shuttered in 2008 alone. One hundred and forty financial institutions closed their doors in 2009, and 157 shut down in 2010. During President Barack Obama’s first term in office, 442 banks closed.

The vast majority of those banks were in small towns and rural areas, such as the First Bank of Idaho, in Ketchum, or Horizon Bank, in Pine City, Minn., or Vantus Bank, in Sioux City, Iowa. On a single day in July 2009, FDIC regulators shuttered six community banks in suburban and rural Georgia. Three weeks earlier, they had closed down six banks in Illinois on a Thursday afternoon.

A few months later, U.S. Bank absorbed nine troubled institutions in Arizona, Illinois, California and Texas on the same day.

“The closing of community banks is a big problem that we haven’t fully addressed,” Morelix said.

Without new businesses to spur job growth, rural parts of America have struggled to repair the damage wrought by the recession even as urban areas thrive. Ninety-seven of the 100 largest counties in America gained population over the last five years; more than two-thirds of the 1,532 counties with fewer than 25,000 residents lost population in that span.

“As the dominant U.S. economy, and especially cities, do better, workers are being pulled out of rural counties,” said Mark Muro, director of policy at the Brookings Institution’s Metropolitan Policy Program.

That population shift is making cities larger, more diverse and younger — and robbing rural America of the people most likely to start new businesses.

“The U.S. population is increasingly older and more diverse, and an older population, even though people are working longer and leading more productive lives, they do eventually retire,” Morelix said. “An older population is associated with less business dynamism.”

Yet younger cities and those that attract immigrants are more likely to see new businesses crop up. Glickman pointed to mid-tier metropolitan areas such as Louisville, Ky.; Columbus, Ohio; Las Vegas; New Orleans — and Salt Lake City.

“Immigrants are disproportionately engaged in the entrepreneur business,” Glickman said. Cities “that are most diversified are able to attract the most types of people, including young people and immigrants.”

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..