Partisans are most likely to flip to these channels

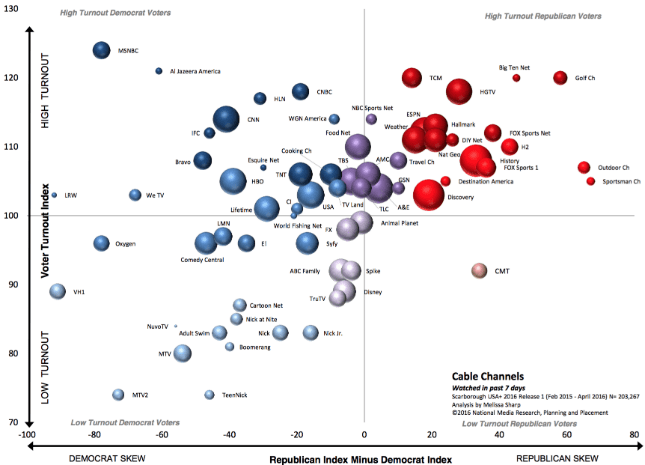

Democrats watch Adult Swim, Comedy Central, Cartoon Network and CNN.

Republicans like the Fox Business Network, the Golf Channel, Outdoor Network and HGTV.

{mosads}Data analysts in both political parties are taking a hard look at partisan preferences for various cable channels ahead of November’s elections, information that gives campaigns and outside groups the opportunity to reach specifically targeted voters on the channels of their choice.

Democratic presidential nominee Hillary Clinton’s campaign has purchased millions in cable advertising on more than 20 individual channels, many of which are preferred by Democrats and persuadable independents.

The Clinton campaign has run the most ads on CNN, a network that Republican nominee Donald Trump has repeatedly criticized.

CNN’s viewers tend to lean Democrat and are disproportionately likely to vote, according to data compiled by Scarborough Research and analyzed by National Media Research Planning & Placement experts Will Feltus and Melissa Sharp.

After CNN, Clinton is spending the most money on advertising on HGTV, the USA Network, TNT, MSNBC and the Food Network.

HGTV is the only network among the Clinton campaign’s channels of choice that tends to have a Republican-leaning audience, though the Food Network is watched by many in both red and blue America.

Clinton is also spending money on Hallmark, Lifetime, AMC, TLC and TV Land. In total, the Clinton campaign has invested in advertising on more than 20 cable channels.

Trump has pursued a different strategy, purchasing more national spots, which air on cable channels across the country.

Trump’s campaign has bought most of its ads on CNBC, the Big Ten Network — which attracts big audiences during Saturday college football games in states like Michigan, Wisconsin, Ohio and Pennsylvania — as well as Fox Sports 1, CNN, MSNBC and Fox News.

The different approaches suggest markedly different strategies that befit each campaign — strategies aimed at the voters each side needs to win over.

“When I look at the two campaigns, I see one’s going after a heavily male [audience]. The Clinton campaign’s going after heavily female,” said Tim Kay, director of political strategy at the cable media firm NCC Media. “When you throw in HGTV, Food, Hallmark, Lifetime, TLC and to an extent TV Land, those are all very skewed female networks.”

As cable networks invest more in groundbreaking programming and audiences rise, campaigns are spending more on cable television advertising — rather than on traditional broadcast stations like NBC, CBS, ABC and Fox — than they have in previous years.

Candidates, including those running for House and Senate seats, and outside groups have spent 44 percent more on cable this year than they had by this time in 2012, Kay said.

The proliferation of cable channels means advertisers can micro-target their ads to reach audiences of likely voters. Campaigns are increasingly doing this, sometimes down to the individual household.

Some viewing habits are obvious.

It’s no surprise that the average Republican television-watcher is four times more likely to tune in to Fox News Channel than the average Democrat. Nor is it shocking that Democrats are twice as likely to watch MSNBC.

CNN’s Headline News and IFC, the Independent Film Channel, have heavily left-leaning audiences.

Republican-leaning voters are most likely to tune in to sports or business channels. Fox Business Network has the most heavily skewed Republican audience, while the SEC Network, the Big Ten Network, Fox Sports 1 and the Golf Channel are also Republican favorites. History Channel and Discovery Channel viewers tend to favor Republicans by wide margins as well.

The most bipartisan channels in America tend to be those that cater to broad audiences or to children. Virtually equal numbers of Democrats and Republicans are watching TruTV, ABC Family, TBS, TNT, Nick Jr. and the Disney Channel.

In total, industry experts expect campaigns to spend more than $800 million on cable advertisements through November’s elections.

Some groups hoping to influence the election are already thinking ahead to the few remaining television events that will attract big audiences before Nov. 8. Priorities USA Action, a super PAC backing Clinton, has already purchased advertisements in some markets during Monday Night Football on Nov. 7, hours before the polls open, when the Buffalo Bills play the Seattle Seahawks.

Other groups see an advantage in buying national advertisements even if their intended audience is much more local. Sen. Ron Johnson’s (R-Wis.) campaign ran advertisements two weeks ago on the Big Ten Network, when the University of Wisconsin Badgers beat the Michigan State Spartans.

Audiences tuning in to the National League Divisional Series between the Chicago Cubs and the San Francisco Giants this week saw advertisements for Measure 5, a San Francisco ballot initiative that would raise taxes on sodas and sugary drinks.

At times, buying a national spot can be less expensive than buying local cable air time, even though the vast majority of the viewing audience won’t be able to vote for a candidate or a ballot measure, Kay said.

Some campaigns are taking advantage of a new feature offered by Comcast called Dynamic Ad Insertion, or DAI in industry parlance. Those advertisements run on programs viewed on demand: When a Comcast subscriber watches a show a few days after it initially airs, the cable network can insert a new ad to run during that show. That allows campaigns to reach viewers who might otherwise skip through the commercials.

The Clinton campaign is using DAI in some critical swing states, including Florida and Colorado, Kay said.

Those advertisements can be particularly appealing to campaigns struggling to reach viewers who are watching less live television. The advent of the DVR, the rise of streaming services like Netflix and growing popularity of on-demand services have all precipitated a decline in live television viewing, according to industry analysts like MBuy.

Nielsen, the television rating service, estimated in 2015 47 percent of American households have a DVR, and 40 percent of households used at least one subscription video service like Netflix or Amazon Prime. Nearly 9 in 10 DVR users fast forward through commercials most of the time.

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..