GOP tax plan a swing and a miss

The day after the World Series ended, House Republicans stepped up to the tax reform plate swinging for the fences. While they should be given credit for taking on a highly challenging subject, they missed the mark.

Instead of drastically reducing the statutory corporate tax rate from 35 percent to 20 percent, as proposed, and generally focusing on increasing corporate cash, changing up their focus to increasing consumer purchasing power would have fit better with economic reality.

{mosads}Many companies need more customers — and customers with cash — more than they need more cash on their balance sheets. Recent history makes this point.

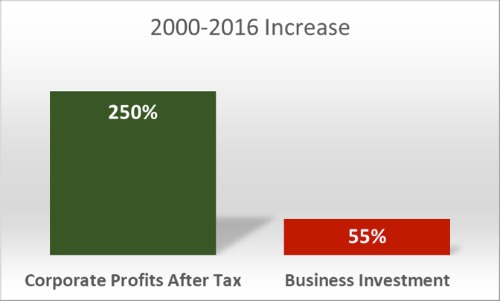

In 2000, the tax rate paid by companies after all deductions, known as the “effective corporate tax rate,” was 29.4 percent. In 2016, the effective corporate tax rate was 18.6 percent. Not surprisingly, corporate profits after taxes increased 250 percent during the same period as companies kept more of their profits.

You would expect, based on today’s arguments for cutting the corporate tax rate, that business investment would have skyrocketed during the same period, but it didn’t. While corporate profits after taxes increased 250 percent, nonresidential business investment increased by just 55 percent.

Source: Solutionomics, Bureau of Economic Analysis

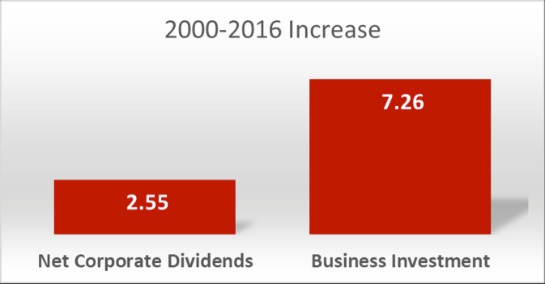

What happened? Instead of business investment skyrocketing as promised, net corporate dividend payments increased 2.55 times from 2000 to 2016 and undistributed corporate profits increased 7.26 times during the same period.

Rather than leading to skyrocketing business investment, corporate dividends and undistributed corporate profits experienced outsized growth. It seems companies didn’t have enough good investment opportunities.

Source: Solutionomics, Bureau of Economic Analysis

Why did companies increase dividends and undistributed corporate profits? Because they didn’t have an equal increase in demand.

From 2000 to 2016, personal consumption expenditures, a measure of the goods and services purchased on behalf of persons in the U.S., only increased 90 percent during the period when corporate profits after taxes increased 233 percent.

That is why companies instead increased dividend payouts and retained more of the after-tax profits. It makes sense. Would a corporation increase investment just because tax rates significantly decreased if consumption didn’t also significantly increase?

Imagine a CEO telling his board of directors that he was significantly increasing production of widgets because tax rates were significantly lower while consumption was not significantly higher.

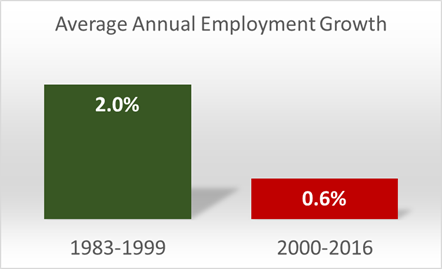

A second argument for corporate tax cuts is that they will increase employment as companies use their increased after-tax profits to increase hiring, but that too hasn’t been the case. What happened to the rate of employment growth when the effective tax rate was lowered from 2000-2016? It declined.

The average annual employment growth rate from 2000-2016 was 0.6 percent. Even if we take out the years of negative employment during the great financial crisis, the average rate of employment growth was only 1.1 percent.

During the previous 17-year period from 1983-1999, the average annual employment growth rate was 2 percent, a period when the average effective corporate tax rate was 27.3 percent, much higher than the 19.5 percent average during the 2000-2016 period.

Source: Solutionomics, Bureau of Labor Statistics

Some may say these facts mean we shouldn’t cut the corporate tax rate, seeing it as an either/or proposition. There is a solution that both provides for the possibility of stimulating economic growth through lower corporate tax rates and ensuring tax cuts only occur in conjunction with job growth: Make lower corporate tax rates contingent on increased employment.

If a company increases hiring, its tax rate is lowered; if it doesn’t, it isn’t. It’s simple: No jobs, no tax cuts. That’s a common sense solution.

Note: Many of the referenced data were calculations made by the author using data from the Bureau of Economic Analysis and the Bureau of Labor Statistics.

Chris Macke is the founder of Solutionomics, a think tank focused on developing solutions and recommendations for a more efficient, merit-based corporate tax code. He has advised the U.S. Federal Reserve by providing market updates and implications of monetary policy changes on asset valuations and market distortions, and he’s a contributor to the Fed Beige Book.

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..