Tax benefits should bubble up, not trickle down

America’s recent economic history has been disruptive. Yet, the tax bill passed by the House and the very similar Senate bill are huge steps in the wrong direction; they will only make our economic problems worse.

The past 35 years have seen a dramatic transformation in the American economy: Middle-class wages have stagnated, economic inequality has surged and labor’s role in the economy has diminished. Children no longer expect to out-earn their parents, and demographic challenges and a high stock of public debt place large burdens on future American workers.

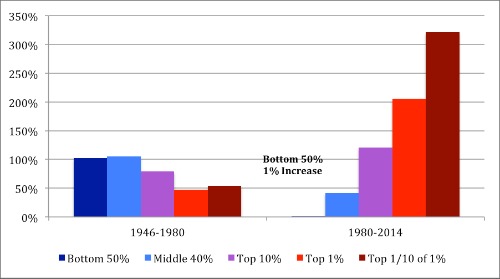

It was not always this way. In the decades after World War II, income gains for those in the bottom 90 percent of households were larger than those for the top 10 percent, wages grew with the economy, and the vast majority of children out-earned their parents. Labor’s share of national income was steady.

Before 1980, Growth Lifted all Boats. Since then, not so much.

Note: Figures compiled based on data from Piketty, Saez, and Zucman.

The reversal of these post-war economic trends frustrates many voters. Economic dissatisfaction fuels political polarization and populist policies. Indeed, many attributed the election of Trump to middle-class economic discontent, although there were clearly other factors at work in his election.

{mosads}What sort of tax policy would we expect from a populist movement? Presumably something that would help those harmed by economic stagnation and income inequality. And indeed, that is how today’s tax plans are marketed, as a boon to American workers that will dramatically increase wages and economic growth.

Yet, when one looks at the actual details of the House and Senate tax bills, one sees that their true priorities are upside down. Claims of help for workers melt into nothing more than trickle-down economics. The House bill provides $1.5 trillion in deficit financed tax cuts.

Of this, $600 billion go to pass-through businesses; 98 percent of these benefits accrue to those with incomes greater than $100,000. Another $150 billion goes the top one-fifth of 1 percent of households that would normally pay the estate tax. And corporate tax cuts total another $750 billion.

About $300 billion of the corporate tax cut is offset by a one-time only tax on foreign profits that have been stashed offshore to avoid U.S. taxation. But that provision itself is a tremendous windfall to shareholders of tax-aggressive companies, who would ordinarily expect to pay a much higher rate upon repatriation.

When all the dust is settled, individuals without estates receive only 15 percent (about $215 billion) of the deficit-financed tax cuts in the House bill. Analysis by the Tax Policy Center shows the top 1 percent with a tax cut of over $60,000 by 2027, while the tax cut for the bottom four-fifths of the population averages only $315 in 2027.

And this ignores the reality that deficits generate borrowing that must be repaid. Once that awkward fact is acknowledged, the middle class faces increasing tax burdens, all to give tax breaks to business owners and those at the very top of the income distribution.

The Senate bill appears marginally better, but still built around the same parameters: large tax cuts to corporations, owners of pass-through businesses and taxable estates, coupled with windfalls to corporations that shifted profits offshore in the past.

On net, individuals (without estates) get about 40 percent of the $1.4 trillion in deficit-financed tax cuts. But, once those deficits are paid for, the middle class again faces increasing tax burdens.

Even more incredibly, recent changes in the bill made it clear that the business tax cuts would actually come at the expense of health insurance affordability, risking coverage for 13 million people and raising premiums for millions of others. The deficits in these tax bills may also trigger mandatory cuts in Medicare.

Beyond that, all of the individual tax cuts in the Senate bill sunset. By 2027, a majority (50.3 percent) of Americans face higher tax increases. While the tax cuts for the middle class expire, the corporate tax cuts are forever. That is a clear statement of priorities if there ever was one.

These bills are being deceptively marketed as essential to the wage growth of the middle class; the tax bills’ backers herald a new era of investment and economic growth. Still, companies have historically high after-tax profits, and the economy is awash in capital.

Companies are missing investment opportunities, but such opportunities require a healthy middle class. The problem is secular stagnation, not excessively high tax burdens; our companies pay effective tax rates that are similar to those paid in other countries.

What would a worker-friendly tax policy look like? It’s quite simple. Direct any tax cuts to workers. Worker prosperity will bubble up to companies and the economy as a whole. We have myriad ways to help workers through the tax code, including expanding the earned income tax credit and focusing any tax cuts on those lower in the income distribution.

Another important way to help American workers is to ensure that government has the tax revenue needed to fund infrastructure, to avoid cuts to education and to meet our obligations to Medicare and Social Security. Revenue for these uses is vital to the well-being of the middle class.

These steps can be combined with sensible revenue-neutral business tax reform. Still, the House and Senate tax bills do not fit that description, nor do they serve the country’s needs. The tax bills generate large tax cuts for business owners, corporate shareholders and estates, at the expense of the middle class and our urgent revenue needs.

After decades of serious economic disruption, these tax bills move us in the wrong direction. And, they are more likely to harm than help American workers.

Kimberly Clausing is the Thormund A. Miller and Walter Mintz professor of economics at Reed College in Portland, Oregon. In 2017, she testified before both the House Ways and Means Committee and the Senate Committee on Finance on tax policy.

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..