Shocking nobody, corporations say tax cuts won’t go to workers

In response to a proposed reduction of tax rates on foreign earned profits, U.S. multinational companies expect to use savings from the proposed reduction to pay down debt, increase share buybacks and pay out more dividends.

In a Bank of America survey of corporations, the most common expected use of proceeds from foreign-earned profits was paying down debt. Surely business investment was next, right? No. The second most common expected use of proceeds was share buybacks.

{mosads}Well, it must have been third on the list? Nope. The third most common expected use of proceeds from tax savings on foreign earnings was mergers and acquisitions. Well, that’s okay because we all know that when companies buy other companies they retain all the employees (insert sarcastic tone here.) Capital expenditures finally came in at No. 4, followed by increasing dividends.

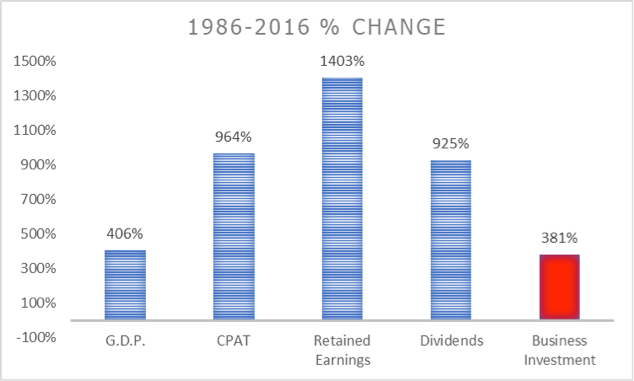

Who could have seen that coming? After all, when companies saw after-tax profits increase more than 950 percent from 1986 to 2016, they increased retained earnings more than 1400 percent and increased dividends more than 925 percent.

Yet, nonresidential business investment increased a paltry 380 percent, not even keeping up with GDP growth. Why didn’t business investment skyrocket? Why did companies keep more money in the form of retained earnings and increase dividends?

Source: Solutionomics calculations using Bureau of Economic Analysis data

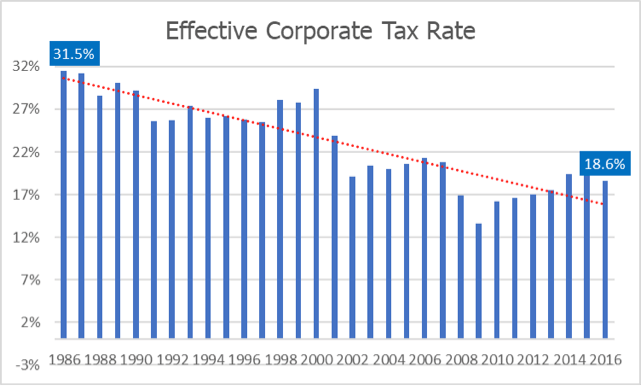

According to the National Economic Council Director Gary Cohn, that wasn’t supposed to happen. From 1986-2016, the effective corporate tax rate declined by nearly half. Gary Cohn would tell us that business investment should have increased far more, as he is promising us today.

Source: Solutionomics calculations using Bureau of Economic Analysis data

Could it have something to do with the fact that companies were making so much money they literally didn’t know where to invest much of it, so they retained more of their profits and increased their dividends? Think about it: Business investment didn’t even keep up with GDP growth. That’s bad.

If companies today have near-record profits and record retained earnings, why would we expect anything different this time? Why would companies flush with more cash than they have ever had on hand suddenly increase business investment?

While some will increase business investment, if history is a guide, not all will, and many have said as much. Cisco’s CEO told Bloomberg, “We’ll be able to get much more aggressive on the share buyback.”

Small wonder so many companies didn’t have business investment at the top of their list of what they would do with a further increase in after tax corporate profits — they already have more cash than they seem to know what to do with.

Yet, Gary Cohn is convinced companies are going to plow their tax savings on foreign-earned profits into business investment. During a recent Wall Street Journal-sponsored event, the moderator asked attendees whether they would increase business investment if corporate tax rates were cut.

Much to Mr. Cohn’s surprise and dismay, very few hands went up. Cohn even asked, “Why aren’t the other hands up?” Somebody please let him know companies have more money than they know what to do with, at least the large companies. He might be shocked.

The most important insight I hope you take away is this: At least some companies need more customers than they need more cash. They need more investment opportunities, which come from increased customer demand.

Instead of unconditionally cutting the tax rate on foreign-earned profits, tie the reduced rates to increased hiring and wage growth. This would allow for larger consumer tax cuts providing companies with that they need, consumers with more cash to buy more company goods.

Chris Macke is the founder of Solutionomics, a think tank focused on developing solutions and recommendations for a more efficient, merit-based corporate tax code. He has advised the U.S. Federal Reserve by providing market updates and implications of monetary policy changes on asset valuations and market distortions, and he’s a contributor to the Fed Beige Book.

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..