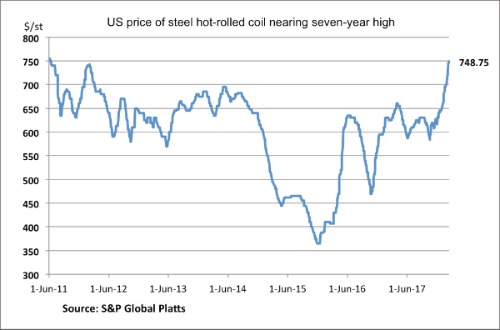

Protecting steel as price is at a 7-year high is a head-scratcher

Steel trade enforcement and infrastructure were key items on the Trump administration’s agenda early this week — at a time when some steel prices in the U.S. are approaching seven-year highs.

Tuesday morning, President Donald Trump went to Capitol Hill to meet with a bipartisan group of lawmakers to talk about trade issues, including the Department of Commerce’s Section 232 reports on the effects of steel and aluminum imports on U.S. national security, submitted to the president in January.

{mosads}The president said “all options” to address the impact of steel and aluminum imports are now being considered.

“I want to keep prices down, but I also want to make sure that we have a steel industry and an aluminum industry, and we do need that for national defense,” Trump said Tuesday.

Fair enough. Let’s examine where steel prices are, where they were and how they might react to stiffer trade restrictions.

Already, in fact, steel prices are up; way up — for a steel material that finds its way into automotive, appliance, agriculture, pipelines, machinery, construction and many other applications.

- The bellwether steel product, known as hot-rolled coil, is at $750 per short ton, from U.S. mills, according to S&P Global Platts’ independent, benchmark daily spot price assessment.

- The spot price of this same product the day after Trump was elected: $500 per ton — up about $250, or 50 percent, since then.

- The price of hot-rolled coil increased steadily after the election through Inauguration Day. Since Trump was sworn in, the price of U.S.-made, hot-rolled coil has averaged more than $630 per ton.

- After one year of Trump, the average price is higher than during President Obama’s two terms — when over those eight years this same product averaged $598 per ton.

- After its boost immediately following Trump’s election, the price rallied for about four months, peaking at $660 per ton in early-April 2017. The Section 232 investigation was announced and launched in April, which actually contributed to an almost immediate price decline. Spooked by the likelihood of import restrictions and possible global supply chain disruption, steel consumers in the U.S. rushed to order more material from offshore and the domestic price weakened by about 12 percent.

- But since the fourth quarter of 2017, the price escalation of U.S.-made, hot-rolled coil has been swift. From the most recent bottom of $583.75 per ton on Oct. 18, 2017, the price, according to S&P Global Platts price assessments, has climbed $165 per ton to a close of $748.75 per ton on Feb. 13. That’s a surge of 28 percent in slightly less than four months.

- This key benchmark is currently at a nearly seven-year high. The last time the U.S.-market price of hot-rolled coil was as high as $750 per ton was June 2011, according to the Platts market data.

Flash back for some possible insight on domestic steel price performance after the imposition of trade restrictions: President George W. Bush on March 5, 2002 signed an order to increase tariffs on imports of certain steel products, effective March 20 of that same year.

Bush’s action was taken based on Section 201 of the Trade Act of 1974. Section 201 allows an industry injured, or threatened with injury, to be safeguarded by duties or other temporary import-relief measures.

Here are the historic prices for U.S.-made hot-rolled coil, for the months in 2002 just prior to Bush’s order, and after:

|

Section 201 market impact, 2002 |

Price of Steel Hot-rolled Coil |

|

January, 2002 |

$230 per ton |

|

February |

$235 |

|

March (Section 201 tariffs effective) |

$270 |

|

April |

$305 |

|

May |

$320 |

|

June |

$350 |

|

July |

$395 |

Source: S&P Global Platts

July of 2002 represented the peak for that year at $395, which was 47-percent higher than just four months earlier. The price declined steadily, to $350 by November and $315 by December.

Nonetheless, from April — immediately after the Section 201 import restrictions — through the end of December, the price averaged $349 per ton. That was $119 more than where it began 2002 (at $230 per ton) and some 52-percent higher.

President Bush’s Section 201 steel tariffs were originally slated to last three years, but they were lifted 14 months sooner, on Dec. 4, 2003.

Like Trump, Bush promised the American steel industry relief. Strikingly similar, Bush pledged a three-pronged approach: launching negotiations to establish disciplines on government subsidies and other market distortions in the steel sector; working to reduce inefficient excess capacity in the global steel market; and requesting initiation of a Section 201.

While the Trump administration chose the Section 232 path — on national security grounds — over Section 201 safeguard measures, there is another important distinction: When Bush acted, the price of steel hot-rolled coil was at a 20-year low.

Trump’s decision will likely come when the price is close to a seven-year high.

Joe Innace is the content director of Metals/Americas for S&P Global Platts. He’s also an award-winning business writer, recognized as Steel Journalist of 2015 by the World Steel Association.

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..