Wage-gain rumors verified as jobs report shoots the moon

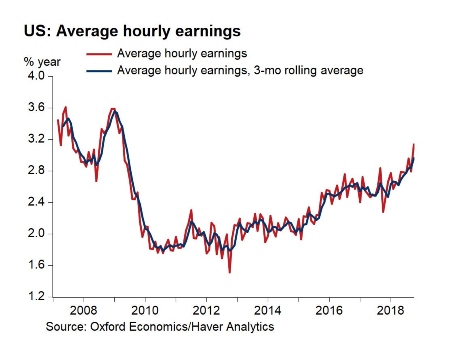

The October jobs report was very strong overall, but if you had to remember one element, it would be that wage growth is accelerating as the labor market nears full employment.

With a 0.2-percent advance over last month, hourly earnings reached their strongest pace in nearly 10 years, as wage growth clocked in at 3.1 percent, year-over-year (y/y).

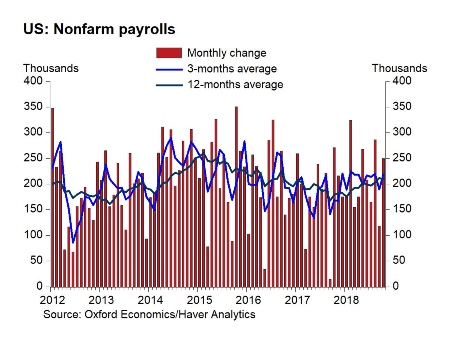

Three other elements were central to this jobs market scorecard. First, the economy added 250,000 jobs, surpassing consensus expectations for a 190,000 gain and showing there is still plenty of fuel left in the jobs growth engine.

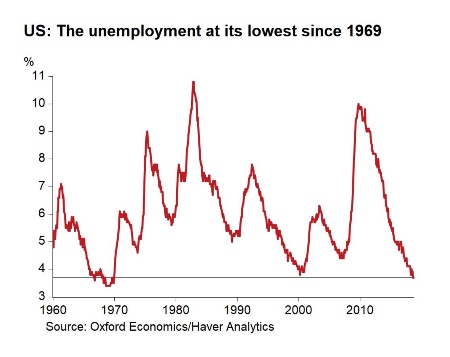

{mosads}Second, the unemployment rate held steady at its 49-year low of 3.7 percent, despite a larger labor force, indicating steady employment absorption.

Third, the labor force participation rose 0.2 percentage points to 62.9 percent, which is an impressive feat against the backdrop of a structurally ageing population and retiring baby boomers pushing down the participation rate.

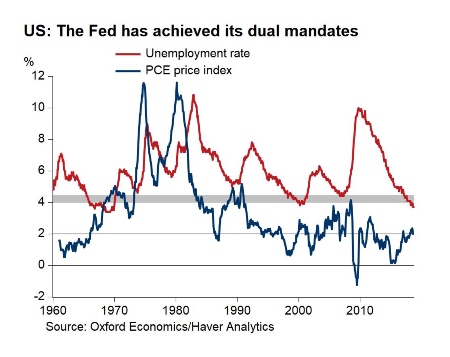

This report plays well for the Fed as it satisfies its dual mandate with firm inflation around its 2-percent target and near-full employment.

With the economy seemingly digesting “gradual” monetary policy tightening and markets showing signs of stabilization in the wake of a tumultuous month of October, it seems very likely the Fed will want to engineer a fourth rate hike this year in December.

Looking into 2019, the Fed will pursue its pragmatic risk management approach with three further rate increases.

1. Wage growth is firming

As expected, hourly earnings rose 0.2 percent in October, bringing wage growth above 3 percent on an annual basis for the first time since 2009.

At 3.1 percent y/y, wage growth has now picked up 0.8 percentage points from 2.3 percent y/y in January, indicating that reduced labor market slack is translating into stronger compensation growth and that anecdotal evidence of companies raising wages is finally turning up in hourly earnings data.

The Employment Cost Index (ECI) for civilian workers — compensation adjusted for compositional shifts in the labor force — corroborates this upward momentum with a 2.8-percent y/y increase in the third quarter (Q3) — the strongest expansion in 10 years.

Similarly, the all-important private-sector wages and salaries ECI component increased 3.0 percent y/y in Q3 — the strongest advance since Q2 2008!

Looking ahead, it seems likely that wage growth with a 3-percent handle will become more common as reduced unemployment, increased worker bargaining power and firming inflation support steady compensation growth.

2. Buoyant job creation despite long cycle and trade tensions

The labor market continues to display very strong resilience with the economy having added jobs for 97 consecutive months — the longest stretch in history. It’s not only the longevity that is impressive but also the fact that the jobs growth remains exceptionally strong.

With 250,000 added in October, the 12-month moving average remains firmly anchored at 210,000 while the three-month average stands at 218,000!

Details in the jobs report were similarly encouraging, with employment in the goods sector rising 67,000, and 179,000 new jobs were created in the services sector.

Construction employment rose an impressive 30,000, while manufacturing employment rose 37,000, indicating that strong domestic activity continues despite the rising trade tensions between the U.S. and China.

While an escalation of tensions between Presidents Trump and Xi would have damaging effects on both economies, we note glimmers of hope leading up to their meeting at the upcoming Group of 20 gathering.

On the services side, job growth was also very encouraging, showing a post-Hurricane Florence rebound in leisure and hospitality employment as well as retail activity. These gains were complemented by resilient employment in transportation and warehousing, education and health care and professional and business services.

3. The lowest unemployment rate since we first set foot on the moon in 1969

While unemployment was unchanged at 3.7 percent, it remains at its lowest since we first set foot on the moon in 1969! What is more, the flat reading came despite a significant 711,000 increase in the labor force, showing that the labor market continues to absorb new entrants into the labor force.

Looking at recent data for unemployment claims and labor market dynamics, it seems likely that labor market slack will continue to decline in the coming month with the unemployment rate finding a likely floor around 3.6 percent by year-end.

4. More individuals are participating in the labor force

The October unemployment data was even more encouraging that labor force participation simultaneously increased to 62.9 percent — near the top of its four-year range of 62.6-63.1 percent. With more and more people deciding to step into the labor market (and finding jobs) these latest numbers point to great employment resilience.

As structural forces from ageing demographics and retiring baby boomers continue to pull down the labor force participation rate, visible upward cyclical momentum is even more impressive.

To put things in perspective, while the official labor force participation rate is 3 percentage points below its pre-recession level, the Oxford Economics age-adjusted measure is only 0.5 percentage points below its pre-crisis level!

Another four rate hikes before the end of 2019

Considering this jobs report, Federal Reserve Chairman Jerome Powell will stick to his “pragmatic risk management” doctrine and continue gradually raising rate to avoid the pitfalls of too-slow or too-fast tightening in the future.

With the economy expected to grow 2.9 percent in 2018 and 2.5 percent in 2019, supported by strong labor market fundamentals and with inflation seemingly well anchored around the Fed’s 2-percent target, it seems likely that the Fed will proceed with a fourth rate hike this year in December.

This will likely be followed by a further three rate hikes in 2019 as the Fed approaches its long-term neutral stance. Of course, this is unless tighter financial conditions or escalating trade protectionism foils these plans.

Gregory Daco is the chief U.S. economist for Oxford Economics.

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..