Equilibrium/Sustainability — Presented by Southern Company — Ivory poaching changes evolution of elephants

Today is Friday. Welcome to Equilibrium, a newsletter that tracks the growing global battle over the future of sustainability. Subscribe here: digital-staging.thehill.com/newsletter-signup.

Decades of ivory poaching across Mozambique have led to the evolution of tuskless elephants — a stark example of how humans are reshaping the face of nature, The Guardian reported.

In a quest to understand why female elephants in Gorongosa national park were often born without tusks, researchers discovered that a once-rare genetic mutation had become common — and that elephants had effectively undergone genetic engineering via ivory poaching, according to The Guardian.

Their findings, published in Science, observed that elephants with tusks were highly prone to hunting during the 1977-1992 Mozambican civil war, while those without tusks were left alone and were therefore able to breed and pass on their tuskless trait.

“We’re literally changing the anatomy of animals,” study leader Robert Pringle of Princeton University told The Guardian.

But Pringle also expressed optimism that conservation efforts could bring a tusk resurgence to Mozambican elephants. And with “such a blizzard of depressing news about biodiversity,” he told The Guardian, “it’s important to emphasize that there are some bright spots in that picture.”

Today we’ll look at a proposal that environmental groups consider to be one such “bright spot” — a plan in California to prohibit oil and gas drilling within 3,200 feet of homes, schools and other sensitive facilities. Then, we’ll look at a federal report that assesses how financial regulation can help cut carbon emissions — if regulators are willing to use them.

For Equilibrium, we are Saul Elbein and Sharon Udasin. Please send tips or comments to Saul at selbein@digital-staging.thehill.com or Sharon at sudasin@digital-staging.thehill.com. Follow us on Twitter: @saul_elbein and @sharonudasin.

Let’s get to it.

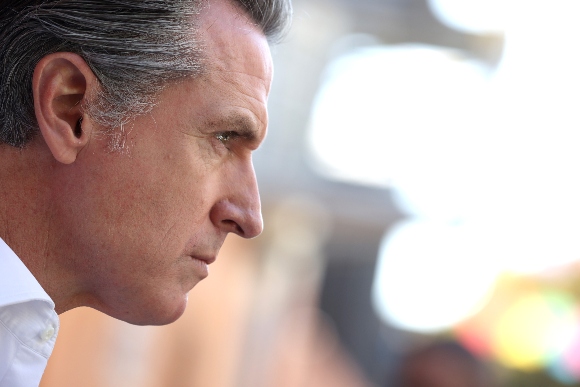

Newsom ‘takes the bull by the horns’

A California energy regulator has proposed a statewide oil and gas drilling ban within 3,200 feet of homes, schools and hospitals to improve public health and curb greenhouse gas emissions, The Hill reported on Thursday.

The proposal, part of a larger statewide move to phase out fossil fuels, would prohibit new wells within that exclusion area — also called a “setback” — and would require pollution controls for existing wells within that same zone, according to the Department of Conservation’s Geological Energy Management Division (CalGEM).

First words: “Our reliance on fossil fuels has resulted in more kids getting asthma, more children born with birth defects, and more communities exposed to toxic, dangerous chemicals,” Gov. Gavin Newsom (D) said in a statement. “California is taking a significant step to protect the more than two million residents who live within a half-mile of oil drilling sites, many in low-income and communities of color.”

Strong connection to disease, adverse birth outcomes: Living within 3,200 feet of oil wells comes with a strong connection to higher rates of adverse birth outcomes, respiratory disease and heart disease, according to energy regulator CalGEM. The regulator compiled its findings together with an expert panel from University of California, Berkeley and the Physicians, Scientists, and Engineers for Healthy Energy research and policy institute.

By creating new setbacks, California was acting to protect “public health, the economy and our environment as we transition to a greener future that reckons with the realities of the climate crisis we’re all facing,” Newsom said.

What happens next? CalGEM is now accepting public comments on the draft rule for the next 60 days, after which it will complete a comprehensive economic analysis of the rule, the governor’s office said. Once that analysis is finalized, CalGEM will submit the proposal to the Office of Administrative Law for additional analysis and refinement of the proposal.

The new restrictions would only likely go into effect in 2023 due to the state’s lengthy process when crafting new regulations, the Los Angeles Times reported. Meanwhile, the proposal is expected to encounter aggressive opposition from the state’s billion-dollar oil industry, according to the Times.

Unlike Texas, Colorado and Pennsylvania, California has never enforced setbacks, despite being among the most progressive states on combating climate change, the Times reported.

A MESSAGE FROM SOUTHERN COMPANY

At Southern Company, we achieved our interim net zero energy goal ten years early. Today, we continue our work toward a net zero future.

OIL INDUSTRY ‘WILL NOT BE CODDLED ANYMORE’

Protecting “the vulnerable among us”: Jared Blumenfeld, secretary of the California Environmental Protection Agency, said that the dominant focus of the regulation is to protect “the vulnerable among us,” as most people who live near oil and gas wells tend to be toward the lower end of the economic spectrum, the Times reported.

“Extracting oil is a dirty business and it’s had a real impact on Californians,” Blumenfeld said, according to the Times. “If any of us had to live next to a pump jack or oil facility, we’d be worried every day about our family’s health.”

Environmental groups applaud the move: Ann Alexander, senior attorney for the Natural Resources Defense Council, praised Newsom and his oil and gas supervisor, Uduak-Joe Ntuk, for “displaying some real leadership chops with this proposal” and for sending “a message to the oil industry that it will not be coddled anymore.”

“California is really taking the bull by the horns this time,” Alexander said in a press statement. “State regulators listened to the scientists and did not shy away from proposing the largest statewide setback requirement in the nation when it became clear that it was needed to protect public health.”

Last words: “It’s a great first step toward freeing these communities and our state entirely from the health and climate harm wreaked by oil drilling,” she added.

Democrats’ secret weapon against fossil fuel emissions

A key federal oversight group has labeled climate change an existential threat to the financial system, and is directing key regulators like the Securities and Exchange Commission (SEC) to do what they can to lower emissions.

In doing so, the group has “put Wall Street on notice” while giving Democrats the tools to make financial regulation one of their key remaining tools in fighting climate change, as Becca Ellison of Evergreen Action told Equilibrium.

First steps: The report by the Financial Stability Oversight Council (FSOC) steered clear of specific prescriptions to financial regulators — avoiding calls for mandatory stress tests, capital requirements or caps on fossil fuel investments, as Sylvan Lane reported Thursday in The Hill.

But by finding that a “disorderly transition” to a low carbon economy was a key threat to the economy, the FSOC opened the potential floodgates for financial regulators to act against emissions in order to stabilize the market, Alex Martin of Americans for Financial Reform told Equilibrium.

An “obvious,” if unstated, conclusion: While Martin voiced disappointment with the report’s lack of specific guidelines, he said that “once you make that call, it’s obvious [that regulators] need to intervene, and the end result of that process will be lower emissions.”

“And that will happen because emissions threaten the financial system,” he added.

“A dereliction of duty”: “The phrasing of the recommendations is extremely weak, with most couched in several layers of caveats,” Yevgeny Shrago, a policy counsel with Public Citizen, told Equilibrium.

But behind all the “as necessary” and “review and consider” clauses was a clear warning to America’s financial system that could be a spur to regulators, Shrago acknowledged.

“If you take what they say seriously about climate being a risk, then there’s no question that regulators need to take a bunch of these actions,” he said, adding that failing to do so “would be a dereliction of their duty.”

A MESSAGE FROM SOUTHERN COMPANY

At Southern Company, we achieved our interim net zero energy goal ten years early. Today, we continue our work toward a net zero future.

A LOOK INSIDE THE REPORT

A new focus on equity: The FSOC report also represented one of the first major assessments from a financial regulator to acknowledge that “communities of color are facing risk from climate first and worse, and they hold the bill most acutely if we go into a climate recession,” Ellison of Evergreen Action said.

Disclosure is fundamental: FSOC’s report included one unambiguous policy prescription: that regulators work to create a rigorous framework for banks and publicly traded companies to disclose their risks from both climate change and the energy transition.

None of this is sufficient, Martin and the others agreed — and yet it is a key step to forcing regulators to confront the magnitude of the economy’s exposure to climate risk.

Once they “look under the hood” at banks and public companies, the SEC and other agencies will likely “see a lot of climate-related risk that is unexpected and has been easy to ignore,” Martin said.

A path around climate gridlock? Recent setbacks on Democratic climate action — like the elimination of the emission-reducing Clean Energy Power Plan (CEPP) from the Biden infrastructure package — makes financial regulation one of the key tools left in the administration’s emissions reduction toolbox, Martin said. But that also gives it enormous power to wield, according to Martin.

“Without that program, there will be far more emissions from the power sector, worse climate change, greater economic impacts from physical damage — and also a more costly, disorderly transition,” he said.

Takeaway: The FSOC report opens the possibility that a key policy lever for addressing climate change comes from its clear and present danger to the economy.

Read our full story on the climate battle turning to Wall Street at TheHill.com this weekend.

Follow-up Friday

Turning back to issues we’ve explored throughout the week.

Deluge of rainfall set to soak a parched California

- As California continues to experience record-breaking drought conditions — which led Gov. Gavin Newsom (D) to extend a drought emergency declaration on Tuesday — the state is now bracing for a deluge of rainfall over the next week, The Washington Post reported.

- Storms that formed over the Gulf of Alaska are generating a “barrage of atmospheric rivers” — slivers of deep tropical moisture — that already started soaking areas from the Pacific Northwest down to central California on Friday, according to the Post.

- Some spots should expect double digit rainfall totals by the end of next week, while more than 5 feet of snow may blanket parts of the Sierra Nevada, the Post reported.

- The precipitation could be what the Post described as “a dramatic turnaround” amid devastating drought conditions and could “make a dent in California’s years-long water deficit.”

For Russia’s far north, climate change is not all bad news

- For the Russian city of Pevek, a once-fading Atlantic Ocean port that began as a Gulag prison, climate change has meant “a rebirth” that has ushered in “a new era,” local museum curator Valentina Khristoforova told The New York Times.

- As Russia explores the impact of climate at home, Putin decided to stay out of the United Nations Climate Conference (COP26), at least in person.

- Though climate change means catastrophe elsewhere in the world, Russia’s Far North is experiencing it as a boom, as a warming climate opens up farming, mining and energy projects — as well as a shipping route across the melting top of the world.

- But “the evidence suggests the risks [of climate change] far outweigh the benefits, no matter how optimistic the Russian government’s language,” Marisol Maddox of Woodrow Wilson International Center told the Times.

- And there are local costs too, as the town warms and new species begin to arrive. “It’s a shame our grandchildren and great-grandchildren won’t see the frozen north as we experienced it,” said librarian Olga Platonova .

Democrats back down on corporate tax to pay for climate, social programs

- President Biden backed away from promises to raise corporate tax rates to pay for a sweeping climate and social reforms, in the president’s latest retreat from a core campaign promise, Reuters reported.

- However, Biden also suggested he might back a change in the Senate filibuster to allow Democrats to pass voting rights with 50 votes, according to Reuters.

- The president’s comments, made in a town hall meeting, follow reports that Democrats have abandoned their push for a Clean Electricity Power Plan — touted by the administration as a key tool to cut emissions.

- The cuts to these key proposals in the proposed infrastructure plan come after an onslaught of corporate lobbying, as well as opposition from Sen. Joe Manchin (D-W.Va.), who earns half a million a year from coal, as The New York Times has reported.

And in paleo-sustainability news…a new study suggests that dinosaurs began hanging out in large, social herds tens of millions of years earlier than previously thought, according to a new study from Massachusetts Institute of Technology.

“There’s a larger community structure, where adults shared and took part in raising the whole community,” coauthor Jahandar Ramezani said in a statement.

Please visit The Hill’s sustainability section online for the web version of this newsletter and more stories. We’ll see you on Monday.{mosads}

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..