Overnight On The Money — Presented by Wells Fargo — GOP senator: It’s ‘foolish’ to buy Treasury bonds

Happy Monday and welcome to On The Money, your nightly guide to everything affecting your bills, bank account and bottom line. Subscribe here: digital-staging.thehill.com/newsletter-signup.

Today’s Big Deal: Republicans digging deeper in opposition to a debt ceiling increase, regardless of the consequences. We’ll also look at a difficult road in the House for Biden’s massive spending bill and the latest on inflation.

But first, find out why Angelina Jolie and I were in the same building today.

For The Hill, I’m Sylvan Lane. Write me at slane@digital-staging.thehill.com or @SylvanLane. You can reach my colleagues on the Finance team Naomi Jagoda at njagoda@digital-staging.thehill.com or @NJagoda and Aris Folley at afolley@digital-staging.thehill.com or @ArisFolley.

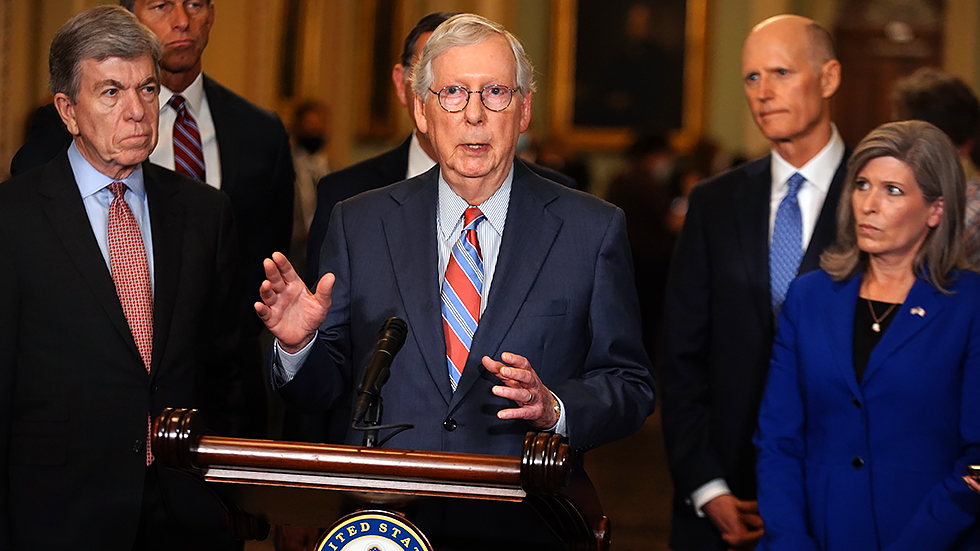

McConnell says GOP ‘united in opposition to raising the debt ceiling’

Senate Democrats are widely expected to package legislation to raise the nation’s debt ceiling with a government-funding measure, an effort aimed at putting maximum pressure on Republicans to support raising the borrowing limit or risk blame for a government shutdown.

But Senate Minority Leader Mitch McConnell (R-Ky.) on Tuesday said that Republicans will vote in unison to defeat any government funding bill that would also raise the nation’s debt ceiling.

“Republicans are united in opposition to raising the debt ceiling,” McConnell declared when asked after a GOP conference meeting whether any Republicans would vote for a funding stopgap that expands the federal government’s borrowing authority, which is expected to be exhausted in October.

McConnell explained that Republicans oppose raising the debt ceiling “not because it doesn’t need to be done” but because doing so would pave the way for Democrats to pass a $3.5 trillion human infrastructure bill that would undo much of former President Trump’s 2017 tax cut.

Fact check:

- Raising or suspending the debt ceiling does not authorize or ban any new spending on its own, nor does it increase or decrease the size of the national debt.

- Hiking the debt limit simply allows the U.S. to issue new Treasury bonds, which it cannot do right now, and generate cash to pay expenses already approved by Congress.

- The U.S. has never defaulted on its debt and experts say any lapse in the full faith and credit of the federal government could trigger a financial system meltdown.

- Countries, financial institutions and investors hold trillions of dollars in Treasury bonds that could plummet in value if the U.S. is unable to stay solvent.

“I’d like every single Republican senator to answer the question, ‘Are they willing to let the government default?’” asked Senate Majority Leader Charles Schumer (D-N.Y.) on Tuesday.

“Leader McConnell, as I said, is playing dangerous political games by not stepping up to the plate as he asked us to do and we did when Trump was president,” he added.

Even so, other Republicans, including moderate Sens. Mitt Romney (Utah) and Rob Portman (Ohio), on Tuesday also ruled out voting for a government-funding resolution that also expands the nation’s borrowing authority.

And that’s why Sen. Rick Scott (R-Fla.) told reporters earlier today that it would be “foolish” to buy Treasury bonds — an asset considered to be almost as safe as cash—amid the standoff.

“If you buy Treasuries today, [you] don’t understand that American taxpayers are not willing to raise taxes to pay for this,” Scott said, though polling has shown solid support for aspects of Biden’s tax plan

“If you’re foolish enough right now to be buying this stuff, you’re foolish,”

I have more on the showdown here.

PRESENTED BY WELLS FARGO

D.C. diner rebuilds with help from nonprofit & Wells Fargo

Flip-It LJ Diner owner Sandra Foote didn’t think her Columbia Heights restaurant could survive COVID-19.

Wells Fargo’s Open for Business Fund provided a grant to the nonprofit District Bridges, which then helped Sandra cover bills.

LEADING THE DAY

House is no easy road for Biden, Democrats on $3.5T package

Democrats say getting the $3.5 trillion social spending plan through the House is going to be a tough road, with Speaker Nancy Pelosi (D-Calif.) only being able to afford three defections to get the measure passed.

While debate in the Senate has received more attention, centrists are also vocally wary of the plan in the lower chamber, while progressives aren’t interested in bending at all.

Some are already privately urging President Biden to be even more involved in the negotiations on the package with Pelosi, arguing a showing of support for his own agenda will be crucial to getting the bill signed into law. The Hill’s Hanna Trudo explains here.

A MESSAGE FROM WELLS FARGO

How a D.C. florist is rebuilding with PPP loans

Le Printemps floral shop in D.C. was able to stay open during the pandemic with two Paycheck Protection Program (PPP) loans booked through Wells Fargo.

85% of PPP loans booked through the bank went to companies with fewer than 10 employees.

MAYBE YOU CAN BUY MY CAR?

Consumer prices rose 0.3 percent in August and 5.3 percent over the past 12 months, according to data released Tuesday by the Labor Department.

Monthly growth in the consumer price index (CPI), a closely watched gauge of inflation, fell for the second consecutive month, dropping from a July increase of 0.5 percent. (Economists expected the CPI to grow by 0.4 percent last month.)

Annual growth in the CPI — one of several ways to measure yearly inflation — also fell from a 5.4 percent rate in July, the highest rate since August 2008.

What happened?

- Prices for airline fares, used cars and trucks, and motor vehicle insurance all fell in August after skyrocketing through most of the spring and summer.

- The CPI for used autos, which drove much of the summer’s increase in inflation, fell 1.5 percent in August but is still 31.9 percent higher than the same point in 2020.

AOC’S MET GALA DRESS, BUT IN LEGISLATION

House Democrats’ plan would impose biggest tax increases on high earners: analysis

House Democrats’ tax proposals would impose the biggest tax increases on households with income of at least $1 million, according to an analysis released Monday by the Joint Committee on Taxation (JCT).

The analysis takes into account Democrats’ proposals to raise taxes on high-income individuals and corporations and to extend the expansion of tax credits for low- and middle-income households.

- In 2023, households with income of more than $1 million would see federal taxes increase by 10.6 percent, and they would see their average tax rate increase from 30.2 percent under current law to 37.3 percent.

- Households with income of less than $200,000 would see their taxes decrease, the JCT said.

Much of Democrats’ proposed expansion of the child tax credit would expire after 2025 — the same time the individual tax provisions in Republicans’ 2017 tax law would expire. Naomi has the details here.

Good to Know

Securities and Exchange Commission Chairman Gary Gensler said Tuesday that the rapid proliferation of cryptocurrencies and investment products tied to them resembled the “wild west.”

Here’s what else have our eye on:

- Opening weekend of the 2021 NFL season saw a record-breaking number of gamblers placing online bets as more states move to legalize sports betting.

- Job searches are expected to increase in the fall as more schools resume in-person learning amid the ongoing pandemic, Indeed’s Hiring Lab forecasted in its latest survey.

That’s it for today. Thanks for reading and check out The Hill’s Finance page for the latest news and coverage. We’ll see you tomorrow.

{mosads}

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..