On The Money — Rising inflation boosts recession fears

Some economists are concerned the Federal Reserve may trigger a recession in its battle to fight inflation, interrupting a historically strong economic rebound. We’ll also look at a new milestone for rising mortgage rates and more pressure to forgive student loans.

But first, find out why Elon Musk wants to buy Twitter.

Welcome to On The Money, your nightly guide to everything affecting your bills, bank account and bottom line. For The Hill, we’re Sylvan Lane, Aris Folley and Karl Evers-Hillstrom. Someone forward you this newsletter? Subscribe here.

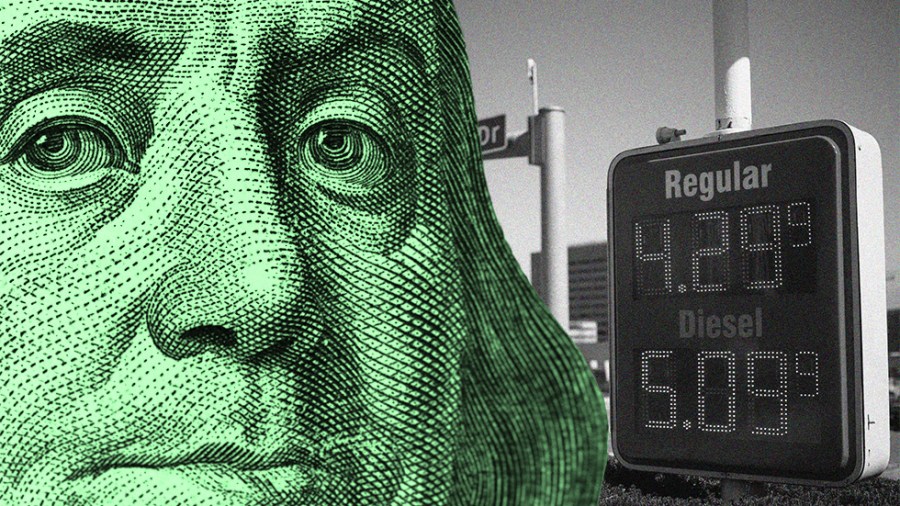

Recession fears rise as Fed fights inflation

As Americans feel the squeeze of rising inflation, fears are growing that a recession is around the corner.

The U.S. economy is running hot as a record stretch of job growth, steady consumer demand and intense demand for labor has helped fuel the highest inflation rate in 40 years.

While the economy has recovered far quicker than many economists expected, the speed of the rebound is putting pressure on the Federal Reserve to take more significant action to help slow price growth.

- The Fed’s primary tool for keeping prices stable and the job market strong is adjusting the federal funds rate.

- When the Fed raises or cuts its baseline interest rate range, borrowing costs for home loans, credit cards and other lending products typically move in the same direction.

- When interest rates rise, consumer and business spending tends to decrease as the costs of borrowing money increase. Higher interest rates also incentivize saving, which means less immediate spending in the economy.

The Fed hopes higher borrowing costs will slow down the economy enough to curb price growth without halting the recovery. But there are a lot of obstacles in the way. Aris and Sylvan explain here.

🌅 Breaking the morning show mold. Bursting the Beltway bubble. TUNE-IN TO RISING, now available as a podcast.

HOUSING TROUBLE

Mortgage rates top 5 percent for the first time in decade

The interest rate for the 30-year fixed-rate mortgage hit a 10-year high of 5 percent on Thursday, continuing steep inclines that started last December in an American housing market where values are surging.

The rate on the most popular U.S. mortgage has climbed nearly 2 points from 3 percent a year ago, according to the latest numbers from mortgage administrator Freddie Mac. The last time the 30-year fixed rate mortgage hit 5 percent was February 2011.

Fifteen-year fixed-rate mortgages averaged 4.17 percent this week, up from 3.91 percent last week and 2.35 percent a year ago.

- The sky-high rates will add about $400 to the monthly mortgage payment for a median-priced home.

- As a result of the spiking rates, the mortgage market is experiencing a dip of activity, with loan application volumes decreasing 1.3 percent compared to a week earlier.

- The National Association of Realtors estimates that home sales will drop by 10 percent this year as 16 million households are priced out of the market due to inflation.

Sam Khater, Freddie Mac’s chief economist, said that the combination of rising mortgage rates, elevated home prices and tight inventory is “making the pursuit of homeownership the most expensive in a generation.”

The Hill’s Tobias Burns has more here.

BIDEN IN THE MIDDLE

Democrats face pressure from left, center on student loans

The question about what to do with an estimated $1.6 trillion in student loan debt is a growing headache for Democrats at a time when families are struggling with higher costs but centrist Democrats led by Sen. Joe Manchin (W.Va.) don’t want to further fuel inflation.

President Biden is stuck in the middle.

- Progressives on his left, such as Senate Majority Leader Charles Schumer (D-N.Y.) and Sen. Elizabeth Warren (D-Mass.), are calling for him to cancel up to $50,000 in student debt, while more moderate Democrats argue that student debt cancellation is regressive and likely to add to inflation.

- But while there is strong reluctance in the Senate Democratic Caucus to forgive up to $50,000 in student debt, moderate Democrats are leery about bashing the idea publicly because they don’t want to run afoul of the party’s base.

- Proponents of student debt cancellation argue that it’s a social justice issue because many Black and minority families possess less wealth compared to white families and are being weighed down with student debt.

Even so, across-the-board student debt forgiveness remains a controversial topic among Democrats in Congress.

Moderate Senate Democrats balked at the idea of canceling all student debt when Sen. Bernie Sanders (I-Vt.) pushed it during the 2020 Democratic presidential primary.

Read more here from The Hill’s Alex Bolton.

PAYOFFS STAY LOW

Jobless claims rise after hitting lowest level since 1968

New weekly applications for jobless aid rose last week after reaching the lowest level since 1968, according to data released Thursday by the Labor Department.

- In the week ending April 9, seasonally adjusted initial claims for unemployment insurance totaled 185,000, up 18,000 from the previous week’s revised total of 167,000.

- Last week’s total was revised up by 1,000 claims but remains the lowest weekly level of seasonally adjusted jobless claims in more than 50 years.

Layoffs have remained near five-decade lows for most of 2022 as employers race to fill a record number of open jobs. The U.S. added nearly 1.7 million jobs this year, with job openings outnumbering unemployed job-seekers by almost 2 to 1. Sylvan has more here.

Good to Know

President Biden on Thursday acknowledged the urgent need to lower costs for Americans, calling on Congress to pass a bipartisan innovation bill as one way to do so.

Biden, speaking at North Carolina A&T University, noted the Labor Department’s inflation report that came out earlier this week showed prices continued to rise over the last month as Russia’s invasion of Ukraine spiked the cost of oil and other goods.

Here’s what else we have our eye on:

- Republican lawmakers cheered an offer by Tesla CEO Elon Musk to buy Twitter on Thursday, arguing that a purchase by the billionaire would reinstate free speech on the platform following its moves to moderate harmful content.

- A poll conducted on behalf of the Democratic Senatorial Campaign Committee found that a majority of battleground state voters would be less likely to support Republicans if the GOP moved to end Medicare, Medicaid and Social Security.

That’s it for today. Thanks for reading and check out The Hill’s Finance page for the latest news and coverage. We’ll see you tomorrow.

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed..